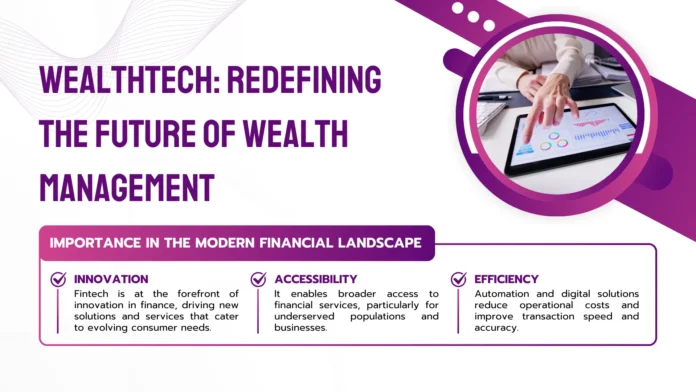

The financial services industry is undergoing a massive transformation, and at the center of it is WealthTech — the fusion of wealth management with technology. From AI-driven advisory platforms to blockchain-based investments, WealthTech is reshaping how investors, advisors, and institutions manage wealth. What was once the domain of high-net-worth individuals is now becoming more accessible, transparent, and personalized.

Why WealthTech Is Disrupting Traditional Wealth Management

- Changing Investor Expectations: Millennials and Gen Z demand digital-first, mobile-friendly wealth management solutions.

- Shift to Democratization: Investors at all levels can now access advanced tools once reserved for the elite.

- Data-Driven Insights: Real-time analytics, predictive modeling, and AI-powered recommendations make wealth decisions smarter.

The message is clear: WealthTech is no longer a niche segment — it’s the future of investing.

Current Market Trends Driving WealthTech

1. AI-Powered Robo-Advisors

- Automated investment strategies tailored to risk profiles.

- Lower fees and 24/7 accessibility compared to traditional advisors.

2. Digital Assets & Blockchain

- Growing acceptance of cryptocurrencies, tokenized assets, and decentralized finance (DeFi).

- Secure, transparent transactions reducing friction in wealth transfers.

3. Hyper-Personalization Through Data

- Leveraging AI and behavioral analytics to deliver customized portfolios.

- Shifting from “one-size-fits-all” to individualized wealth journeys.

4. Sustainable & Impact Investing

- Rising demand for ESG (Environmental, Social, Governance) focused portfolios.

- WealthTech platforms integrating sustainability scoring into investment recommendations.

5. Embedded Finance & Hybrid Advisory

- Combining digital platforms with human expertise for complex financial planning.

- Seamless integration of banking, insurance, and wealth services in one ecosystem.

Benefits of WealthTech for Investors and Advisors

- Investors: Greater transparency, lower costs, faster access, and personalized experiences.

- Advisors: Scalable solutions, deeper client insights, and more time for strategic guidance.

- Institutions: Enhanced compliance, automation, and expanded customer reach.

WealthTech is not about replacing human advisors but augmenting them with technology to deliver more value.

The Road Ahead for WealthTech

As technology adoption accelerates, WealthTech is set to drive:

- Wider access to financial literacy and wealth creation tools.

- Integration of AI, blockchain, and open banking into mainstream wealth management.

- A shift from transactional advisory to relationship-based, tech-powered financial ecosystems.

The future of wealth management belongs to firms that combine trust, transparency, and technology.